Though we do not independently vet each and every Google advert, we keep track of for quality and maintain expectations for immediate advertisers who want placement on our website. Certainly, we make money once you simply click, but we prioritize your searching working experience above cramming in highest adverts despite relevance.

Stick with your trading prepare: After getting a trading plan, it is important to stay with it. Stay clear of making impulsive decisions depending on feelings, and in its place, count on the trading system's rules.

On a regular basis examining your ambitions and evaluating how you are executing is vital to remain determined and monitor your progress. Celebrate your successes and use any setbacks as an opportunity to learn and improve.

Following the achievement of joint-stock corporations in fostering economic advancement coupled with geographical growth, those had been manufactured a mainstay from the economical world.

When a totally harmonized world wide carbon procedure is not likely, interoperability offers a useful route forward for tackling emissions embedded in trade. Meaning countries get the job done to harmonize exactly where doable and understand equivalent plan outcomes.

Reversal Trading: A strategy that involves buying securities which have fallen in selling price or marketing securities that have risen in cost. A reversal focused working day trader will try to find securities which can be oversold or overbought and anticipate them to revert for their indicate.

The goal should be to take advantage of the decrease within the asset's value. Nonetheless, shorter advertising is usually risky, as possible losses are theoretically endless If your asset's price tag increases in its place.

"It has been a real roller-coaster. A wild ride," said Ed Yardeni, president of investment advisory Yardeni Investigate. In early February, the runaway coach stock market ran smack into spiking bond premiums which were pricing in the threat of inflation. Investors suddenly turned worried the economy, boosted by huge tax cuts, could overheated and drive the Federal Reserve to lift fascination charges. It definitely didn't aid that the post-election surge experienced still left stocks comparatively costly — and vulnerable to a sharp pullback. "February are going to be remembered as being the thirty day period in which dread of unbridled inflation fulfilled with valuations nicely further than historical norms," stated Peter Kenny, senior market strategist at the worldwide Markets Advisory Team. Inflation fears have triggered the Dow and S&P five hundred to try and do a little something they have not in 11 months: drop. Equally indexes had their worst thirty day period in two a long time. And yet it took very little time with the market to storm back again off the lows as investors, emboldened because of the strong overall economy and soaring earnings, jumped into the fray to acquire stocks. All 3 significant indexes are up once more to the year, and the Nasdaq is down just one% for the thirty day period. "The rebound has long been quite spectacular, very much a V-shaped comeback," Kenny explained. Associated: Dilemma with climbing prices: Corporate The usa has a huge amount of personal debt Regardless that the market has bounced back, the recovery is fragile — and remains subject matter on the whims of the bond market. Just take a look at how the Dow dropped 299 points on Tuesday after the 10-calendar year Treasury fee crept closer to 3%. The market-off, pushed by Fed chief Jerome Powell's upbeat outlook over the economic system and inflation, despatched the VIX (VIX) volatility index spiking all over again. The fear is usually that a sudden inflation spike will result in the Fed to chill the financial state off by aggressively elevating fees, ending the get together on Wall Road. "The concern is whether inflation rises at this type of swift rate that it produces a headwind with the market," explained David Joy, chief market strategist at Ameriprise. Wall Road is glued to The ten-yr Treasury level stocks as it aids established the value on pretty much all other property.

They might handle their thoughts and keep willpower, even in high-tension scenarios. This enables them to generate rational conclusions centered on their own trading system, as opposed to reacting emotionally to market actions.

Get skilled guidance on obtaining the best broker, learn to trade stocks, and know how To guage the markets.

Trading penny stocks throughout the tech sector offers the possible for tapping into rising businesses poised for advancement, driven by their involvement in slicing-edge technologies, impressive solutions, and market-disruptive expert services.

As well as, we’ve compiled a trading for rookie’s guidebook below To help you in having informed about the several markets.

All mental property legal rights are reserved via the vendors and/or even the exchange supplying the data contained Within this Site.

Placement traders keep securities for months aiming to capitalise on the very long-phrase probable of stocks rather then short-term cost movements. This type of trade is right for people who're not market experts or typical individuals of the market.

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Ariana Richards Then & Now!

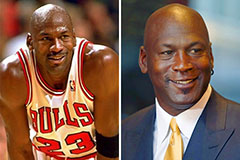

Ariana Richards Then & Now! Michael Jordan Then & Now!

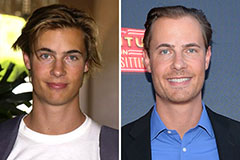

Michael Jordan Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Katey Sagal Then & Now!

Katey Sagal Then & Now!